Palantir (NASDAQ: PLTR) has managed to be comparatively resilient amid the current turmoil within the inventory market. As of this writing, the inventory is up 17% 12 months thus far regardless of pulling again 27% from the all-time excessive it reached in February.

That is nonetheless a premium-priced inventory, although. Palantir trades at 158 instances this 12 months’s anticipated earnings and 55 instances anticipated gross sales. That is an especially bullish valuation — and one that appears even pricier contemplating macroeconomic headwinds may sluggish the corporate’s current momentum.

Whereas there is not any doubt Palantir is an costly inventory by these typical valuation metrics, there’s one other indicator that places the inventory’s price ticket in a extra cheap mild.

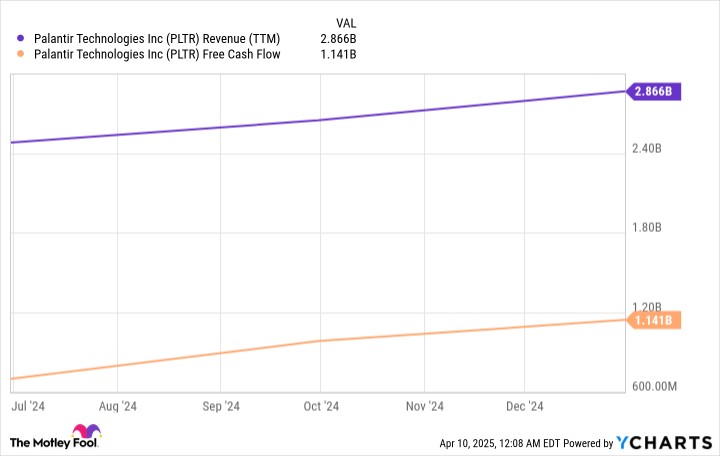

Although Palantir inventory appears fairly costly on a price-to-earnings foundation, there are some good explanation why buyers have been keen to pay a premium to personal the inventory. For instance, simply check out the chart under, which tracks the corporate’s gross sales and free cash flow (FCF) during the last 12 months.

For 2024, Palantir generated FCF of $1.14 billion on income of $2.86 billion. In different phrases, the corporate is producing $0.40 in free money stream for each $1 in gross sales recorded. That is a improbable margin — and one that appears even higher within the context of Palantir’s high line momentum.

Final 12 months, income elevated 29%, and administration tasks progress will enhance to 31% this 12 months (on the midpoint of the steering vary). The bogus intelligence software program supplier is posting a FCF margin that will be enviable for a worthwhile however slow-growing, mature enterprise, however its income progress has accelerated for six straight quarters.

With Palantir having established itself as a go-to supplier of highly effective analytics instruments for each business and authorities purchasers, the corporate seems poised to take care of its robust progress trajectory. In the meantime, its robust FCF margin will assist Palantir climate any commerce struggle and different macroeconomic dangers. In that mild, the inventory’s price ticket is not as unreasonable as typical valuation metrics may counsel.

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 best stocks for buyers to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Netflix made this checklist on December 17, 2004… in the event you invested $1,000 on the time of our advice, you’d have $495,226!* Or when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $679,900!*

Now, it’s price noting Inventory Advisor’s complete common return is 796% — a market-crushing outperformance in comparison with 155% for the S&P 500. Don’t miss out on the newest high 10 checklist, accessible while you be a part of Inventory Advisor.

Source link