It is no secret that the inventory market took an enormous nosedive after President Donald Trump revealed his “reciprocal tariff” plans, however there are some areas of the market that took the information worse than others.

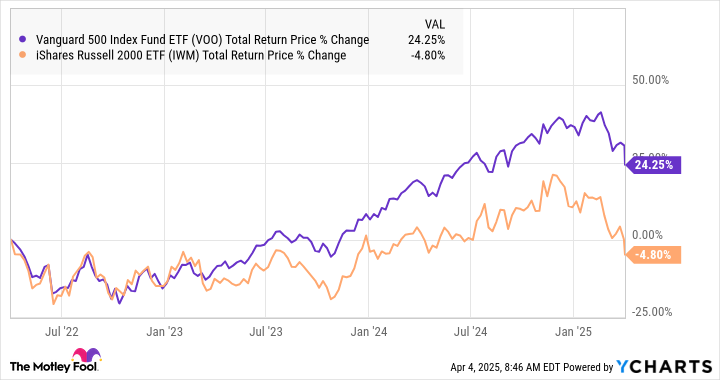

In reality, the Russell 2000, which is extensively thought-about to be essentially the most complete index of small-cap shares, has now formally fallen into bear market territory. The day after the tariff announcement, the index fell to a degree that’s 22% under its latest excessive, and the futures markets point out that it could possibly be considerably decrease by the point you are studying this.

Not solely has the Russell 2000 dramatically underperformed the broader inventory market, however small-cap shares have been already slightly low-cost, relative to their large-cap counterparts, coming into 2025. Here is the place issues stand with the small-cap benchmark proper now, and why investing within the Russell 2000 proper now could possibly be an effective way to set your portfolio up for years of market-beating returns.

Small-cap shares are buying and selling on the lowest valuations relative to the S&P 500 in a long time, and the hole continues to widen.

At first of 2024, Fundstrat analyst Tom Lee appropriately identified that small caps have been buying and selling for his or her lowest price-to-book multiple relative to giant caps since 1999. And since that point, the hole has widened significantly. Final 12 months, the Russell 2000 underperformed the S&P 500 by about 14 proportion factors, and it has underperformed by one other 6 proportion factors already this 12 months.

The hole is a bit mind-boggling. The typical S&P 500 part trades for a price-to-earnings ratio of 26.8, and for a price-to-book a number of of 4.8. However, the common part of the Russell 2000 trades for 17.5 occasions earnings and for a P/B ratio of simply 1.9.

To be truthful, large-cap shares have grown their earnings at a considerably sooner fee in recent times (primarily because of the success of megacap know-how shares). However not by sufficient to justify a price-to-book valuation that is about 150% larger.

Lee additionally identified that the final time the hole was so vast, small caps went on to outperform giant caps for the subsequent 12 years, and by a complete of 113 proportion factors above the S&P 500.

In fact, there is no assure that the identical factor will occur this time round. However there are good causes to consider that small caps could possibly be set as much as outperform. For instance, small-cap shares have a tendency to learn extra from rate of interest cuts, as a result of sometimes larger dependence on borrowed cash, in addition to elevated urge for food for investor hypothesis as charges on risk-free investments fall.

Source link