Trainline (TRN.L) has revealed it made a report quantity from ticket gross sales final 12 months, however its share worth plummeted on Thursday amid issues over Authorities plans for a rival nationwide ticketing app.

The London-listed agency made £5.9 million from promoting tickets within the 12 months ending February, 12% up from the 12 months earlier than however on the backside finish of steerage given in October.

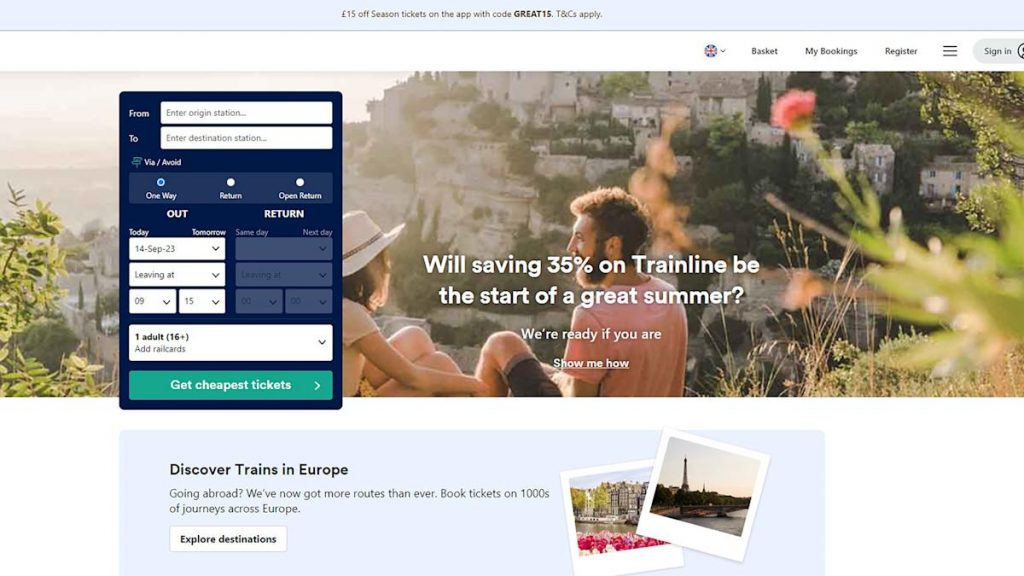

Trainline makes most of its cash by taking a fee on ticket gross sales for coach and rail journeys, and benefitted from fewer practice strikes final 12 months than in 2023.

It additionally cited the rising reputation of digital tickets saved on cell phones versus paper tickets for its bettering gross sales.

Trainline additionally introduced a £75 million payday for shareholders via a buyback programme.

However it was not sufficient to assuage issues over competitors from a Authorities-owned practice operator known as Nice British Railways.

Trainline has grown rapidly lately as a manner to assist prospects discover tickets in a rail system with scores of personal sector firms, typically working on the identical route.

Shares fell 14% amid worries that Labour’s proposed simplification of the system to make it extra consumer-friendly may harm Trainline’s dominant place available in the market.

The rising gross sales got here primarily from throughout the UK, the place earnings grew 13% to £3.9 billion, whereas worldwide ticket gross sales elevated 4% to £1.1 billion.

In Spain, it noticed gross sales rise 41% whereas its business-to-business providing additionally put in a powerful displaying, with 60% development.

“Spain is the market with most widespread provider competitors, which is enabling Trainline to develop rapidly on this market,” it mentioned.

Chief govt Jody Ford added: “Our decades-long expertise in delivering ease, selection and worth for our 27 million prospects units us other than the competitors, be it international tech gamers or nationwide incumbents.

“There’s nonetheless a lot to be achieved within the UK and Europe, with the important basis being open, truthful and aggressive markets.”

Source link