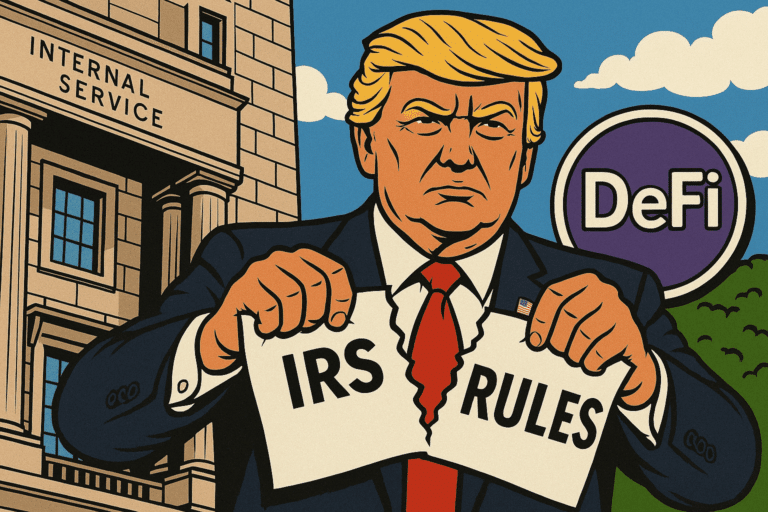

What Was the IRS DeFi Dealer Rule?

This rule required decentralized finance (DeFi) platforms to report their customers’ transactions to the IRS. It additionally tried to redefine who constitutes a “dealer” in DeFi, which included quite a few software program builders and members in protocols. The rule brought on concern concerning privateness, innovation, and regulatory burden.

Many within the crypto house believed it will:

- Infringe on consumer privateness

- Overwhelm the IRS throughout tax season

- Discourage blockchain innovation

- Deal with non-custodial gamers unfairly

How the Invoice Was Handed

This invoice, formally referred to as H.J. Res. 25, was launched by Senator Ted Cruz and Consultant Mike Carey below the Congressional Evaluation Act (CRA). The CRA permits Congress to repeal latest federal rules.

The decision handed each chambers with sturdy bipartisan assist:

|

Chamber |

Vote Depend |

|

Senate |

70–28 |

|

Home |

292–132 |

Consultant Carey emphasised that that is the first crypto-related legislation ever signed and likewise the first CRA measure on a tax issue to change into legislation.

“This invoice frees the crypto house from pointless burdens,” Carey stated. “It places focus again on actual taxpayer wants.”

Trade Response: A Win for Crypto Innovation

Trade leaders welcomed the choice. Bo Hines, Government Director of the President’s Council of Advisers on Digital Property, expressed sturdy assist on X (previously Twitter):

“Enormous second! First crypto laws ever. Repealing the IRS rule protects innovation and privateness. An enormous step ahead.”

Many within the crypto group noticed this as a constructive sign. The transfer is predicted to draw extra innovation, defend privateness rights, and scale back crimson tape for builders and customers within the DeFi ecosystem.

SEC’s New Steerage Brings Readability

The identical day this invoice was signed, the SEC launched recent steering by its Division of Company Finance. The aim? Clearer guidelines round how securities legal guidelines apply to crypto asset choices.

Key factors of the SEC steering:

- Choices should disclose dangers like worth swings and tech challenges

- Transparency is crucial to guard traders

- Guidelines apply to all crypto-related securities choices

This steering is seen as a step towards a extra balanced and knowledgeable regulatory system for crypto markets.

Helium Community Will get Regulatory Reduction

In one other main transfer, the SEC dismissed securities costs towards Nova Labs, the crew behind Helium Network. This meant Helium’s tokens – HNT, MOBILE, and IOT – are now not thought of unregistered securities.

Helium responded with optimism:

“Now, Helium and DePIN tasks can develop freely. We’re prepared to assist join the world with out boundaries.”

This determination displays a change in how the SEC is approaching crypto enforcement. Since Gary Gensler’s exit in January 2025, the company has dropped a number of lawsuits and softened its stance on crypto.

Ripple Lawsuit Additionally Settled

Simply weeks earlier than, the SEC additionally dropped its long-running authorized battle towards Ripple. A joint movement was filed to pause the attraction course of as either side labored towards a settlement. This provides to the general regulatory shift seen below the brand new administration.

The Greater Image

Collectively, these developments present a transparent change in path:

- The U.S. is beginning to embrace digital property

- Lawmakers are focusing extra on innovation than punishment

- Companies just like the SEC and IRS are being pushed to make clear and simplify guidelines

For the world of crypto, it is likely to be the beginning of a freer and extra nurturing period. Buyers and builders alike might even see it as less complicated to take a position and develop, with fewer authorized obstacles to beat.

Source link