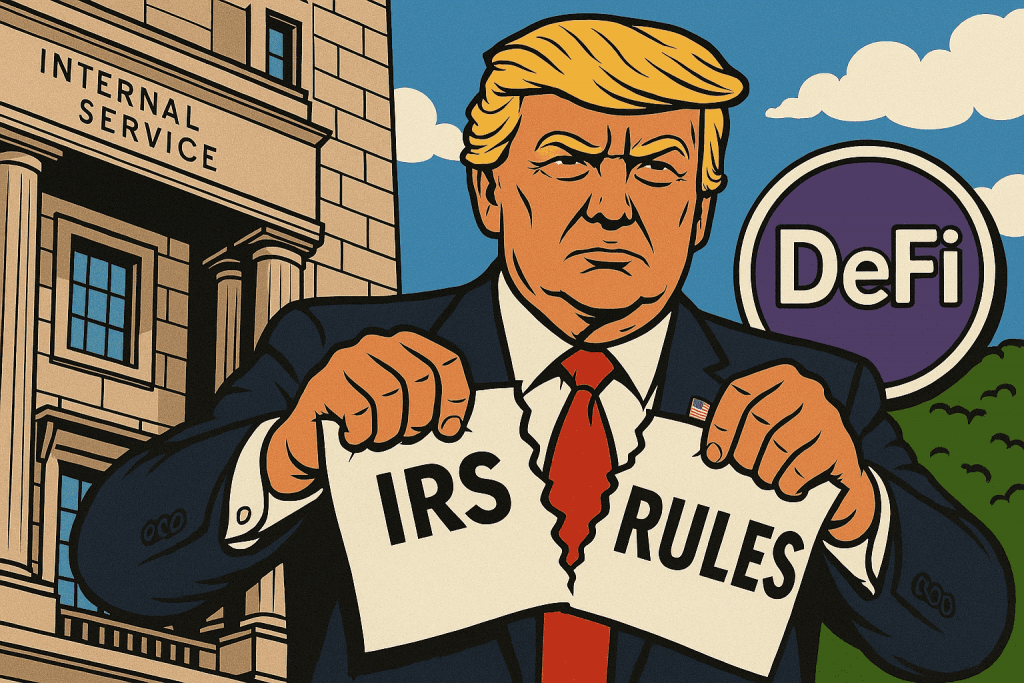

No less than for now, the crypto business simply scored a serious win with this new replace associated to IRS crypto reporting. On April 10, 2025, President Donald Trump signed off on a invoice that formally killed an IRS rule requiring decentralized finance (DeFi) platforms to report consumer transaction knowledge to the federal government. This rule, finalized late final yr below the Biden administration, had expanded the definition of a “dealer” to incorporate conventional crypto exchanges and DeFi protocols, even these that run on sensible contracts with no single worker.

The rule initially stemmed from the 2021 Infrastructure Funding and Jobs Act, which aimed to crack down on crypto tax evasion. Lawmakers figured the IRS ought to know in case you’re making positive aspects in DeFi. However the issue? DeFi protocols don’t work like centralized exchanges. They don’t have KYC types or customer support desks. There’s no simple manner for them to report consumer knowledge, even when they needed to.

Legislative Response and Repeal To Trump Tax Shake-Up

Quick ahead to 2025, and the backlash hit a boiling level. Trade leaders, builders, and lawmakers alike referred to as the rule unworkable. Enter the Congressional Overview Act, a hardly ever used software that lets Congress reverse newly finalized laws with a easy majority vote.

TRUMP TO SIGN FIRST-EVER CRYPTO BILL—DEFI BROKER RULE IS DEAD

The Senate simply crushed the IRS’s DeFi surveillance rule 70-28 after the Home already demolished it 292-132, handing crypto builders a large win in opposition to authorities overreach.

Critics celebrated the dying of… https://t.co/6crwWO0ocq pic.twitter.com/tRvlJglhkJ

— Mario Nawfal (@MarioNawfal) April 11, 2025

Republicansled the charge, with Rep. Mike Carey (R-Ohio) and Sen. Ted Cruz (R-Texas) on the forefront. Their argument? The rule was overly broad, poorly thought out, and risked crushing innovation in a sector the U.S. must be main—not regulating into oblivion.

The invoice breezed by way of each chambers of Congress and landed on Trump’s desk, the place he wasted no time signing it. The transfer marks the primary piece of crypto-related laws enacted throughout his second time period.

What Do Trump Tax Adjustments Imply For the Crypto Trade?

Naturally, the crypto world is respiratory a little bit simpler. For DeFi builders, this implies they received’t be anticipated to do the unimaginable, like reporting on customers they don’t management and even know. The repeal removes a serious regulatory headache and alerts that the federal government would possibly lastly be making an attempt to know how decentralized techniques truly perform.

That mentioned, it’s not all champagne and memes. Some consultants fear the repeal leaves a gaping gap in tax enforcement. With out clear reporting, the IRS may have a more durable time monitoring positive aspects from DeFi exercise. And whereas which may sound like a win for privateness advocates, it raises long-term questions on whether or not the area can develop sustainably with out accountability.

IRS Crypto Reporting in 2025 and Past?

This isn’t taking place in isolation. The Trump administration has been shifting quick on crypto coverage. In only a few brief months, Trump has signed an government order to create a nationwide Bitcoin reserve and launched a working group targeted on rewriting the federal strategy to digital belongings.

The message is obvious: this White Home needs a hands-off, pro-innovation stance on crypto. Nevertheless, whether or not that results in smarter regulation or simply much less stays to be seen.

Within the meantime, DeFi will get to maintain constructing. The query is: can the area self-regulate earlier than one other wave of guidelines comes crashing again?

DISCOVER: 20+ Next Crypto to Explode in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

President Trump repealed the IRS rule that compelled DeFi platforms to report consumer transactions, scrapping a serious Biden-era regulation. -

The unique rule labeled DeFi protocols as “brokers,” regardless of their lack of centralized management or consumer knowledge. -

Crypto business leaders and lawmakers referred to as the rule unworkable, resulting in its repeal by way of the Congressional Overview Act. -

The transfer alerts a shift towards pro-innovation crypto coverage below Trump’s second time period. -

Whereas builders have fun, some consultants warn the repeal weakens tax enforcement and leaves a regulatory hole.

Source link