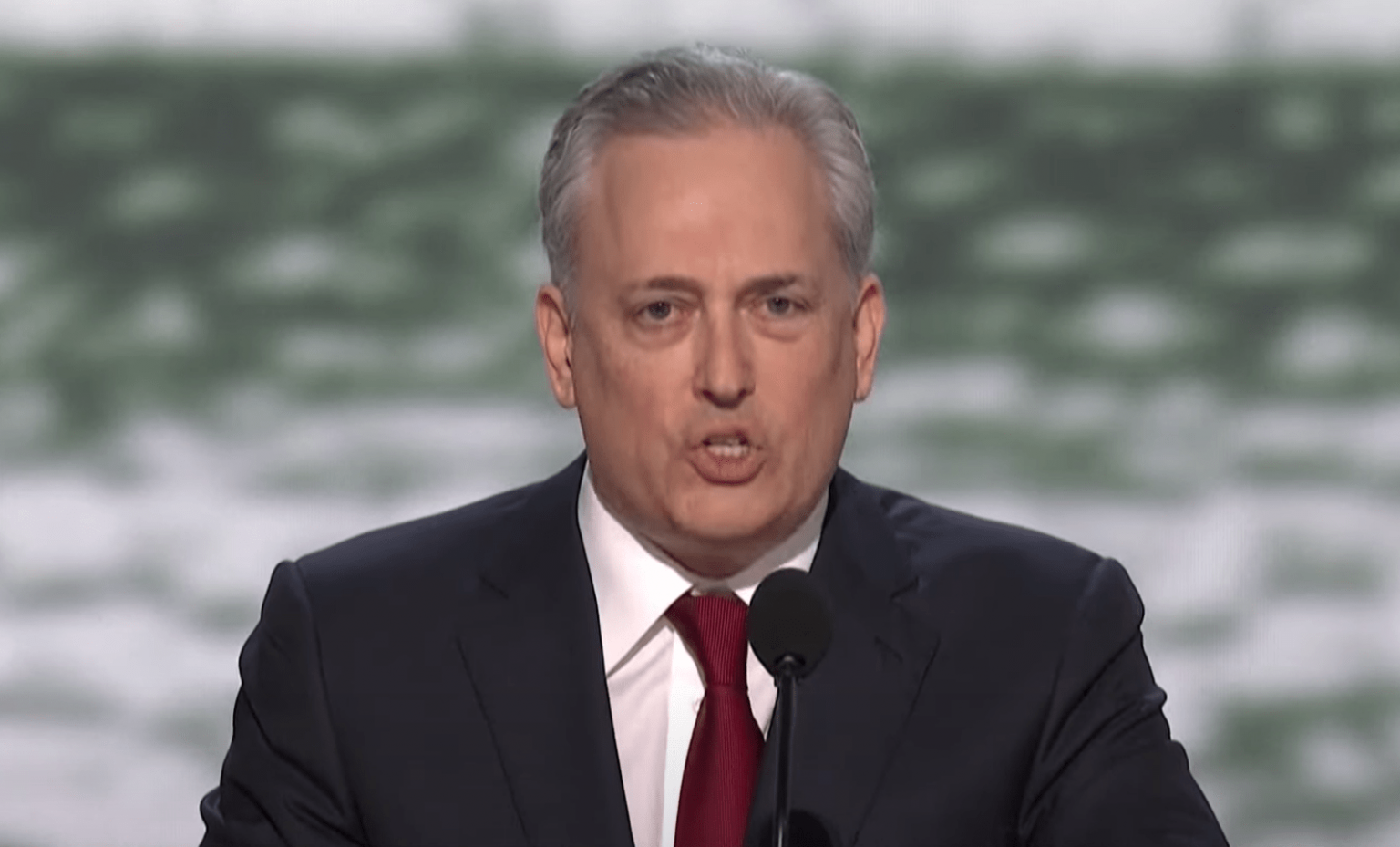

Solana (SOL) might be one of many largest winners from the nomination of David O. Sacks as White Home Director of Synthetic Intelligence and Cryptocurrency. President-elect Donald J. Trump has appointed David Sacks as “Crypto Czar” on Thursday.

Trump acknowledged that Sacks will work to develop a authorized framework to supply the crypto trade with the readability it has been looking for, permitting the trade to flourish in america. Sacks brings a high-profile background to the function: he was Chief Working Officer of PayPal throughout its early life and serves as an advisor to the 0x protocol.

Associated Studying

Recognized for his lengthy standing help of Bitcoin as a decentralized hedge towards conventional finance and a proponent of decentralized finance (DeFi) for growing transparency within the monetary system, Sacks has additionally invested in a number of cryptocurrency tasks via his enterprise capital agency, Craft Ventures.

Why Sacks Is Tremendous Bullish For Solana

Amongst his most notable exposures is his early funding within the Solana blockchain, achieved via the crypto-focused funding agency Multicoin Capital. In 2023, Sacks confirmed that he maintained his Solana (SOL) place regardless of the FTX-related market turbulence and remained “up massive.”

Craft Ventures’ early involvement with Solana, through Multicoin Capital, reportedly generated substantial returns. In response to Sacks’ personal account on a podcast (when SOL stood at $169), this funding soared to a valuation round $1 billion.

“That fund, I imply, it’s like a 100x fund, it’s similar to bonkers. And so because of that, we’re oblique beneficiaries of this big enhance in Solana. It would find yourself being about, , a billion {dollars} of, I feel, Solana for us by way of returns, however the MultiCoin guys decide the buying and selling choices on that,” Sacks revealed throughout a podcast.

Sacks has mentioned Solana intimately on the All-In Podcast with Chamath Palihapitiya, the founder and CEO of Social Capital. Their conversations have highlighted Solana’s functionality to help speedy, cost-effective transactions at scale, usually evaluating its structure and throughput favorably towards that of Ethereum.

“There’s lots of people, I’d say sensible cash in Silicon Valley, who’re betting on a flippening the place Solana may finally overtake Ethereum as the popular platform,” Sacks remarked.

Associated Studying

Notably, a spot Solana ETF is simply across the nook within the US with 5 applications already filed with the US Securities and Trade Fee. With the appointment of Sacks, the chance of a spot SOL ETF following the departure of Gary Gensler as SEC Chairman on January 20 is more likely to have elevated additional.

Solana’s sturdy fundamentals and rising institutional recognition are being mirrored in its worth motion. At press time, Solana is buying and selling slightly below a brand new all-time excessive established two days in the past at $264.39, having surpassed its earlier file from October 2021 at $259.90.

Ought to SOL breach this newly fashioned resistance degree, technical analysts level to potential upside targets. These embrace the 1.272 Fibonacci extension at round $328 and the 1.618 Fibonacci extension at roughly $415.

At press time, SOL traded at $234.

Featured picture from YouTube, chart from TradingView.com

Source link