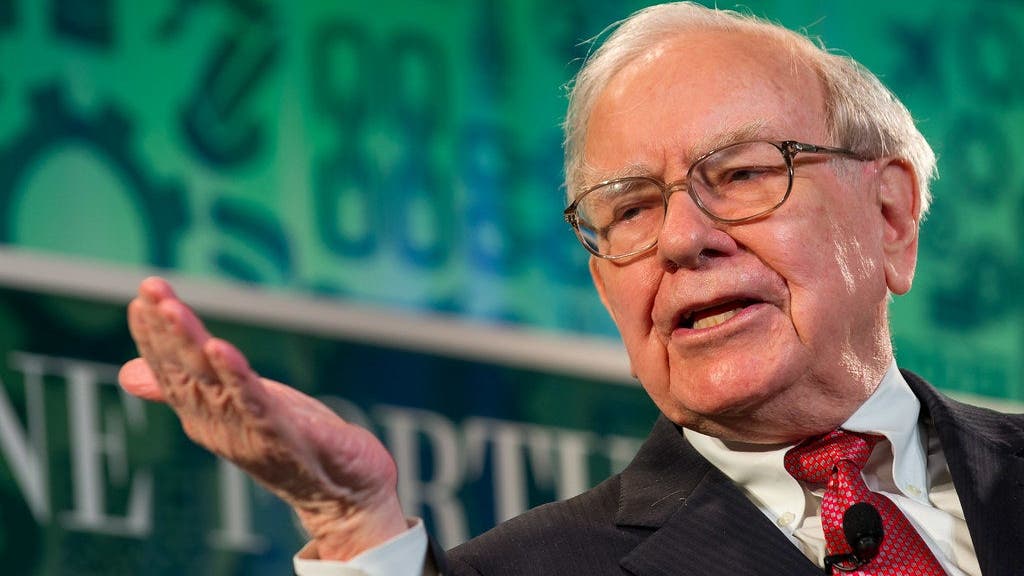

Don’t wait to get began if you wish to be as wealthy as Warren Buffett. That is the recommendation the legendary investor shared in 1999 at Berkshire Hathaway’s annual shareholder assembly. Buffett had a web value of about $30 billion on the time. At present, his fortune has grown to over $147 billion. When requested methods to construct such wealth, Buffett did not hesitate.

“Mr. Buffett, how can I make $30 billion?” somebody requested. Buffett laughed and responded, “Begin younger.”

Do not Miss:

He then went on to clarify his philosophy, utilizing his signature snowball analogy. “Charlie’s at all times mentioned that the large factor about it’s we began building this little snowball on top of a very long hill,” Buffett mentioned, referring to his longtime enterprise associate, Charlie Munger. “So we began at a really early age in rolling the snowball down, and naturally, the snowball – the character of compound curiosity – is it behaves like a snowball of sticky snow.” The important thing, he defined, is having a “very lengthy hill,” which suggests both beginning early or residing an extended life.

However what for those who’re not a teenage investing prodigy? Buffett laid out precisely how he’d method investing if he had been beginning over with simply $10,000. “I’d do it precisely the identical means if I had been doing it within the funding world,” he mentioned. “If I had been getting out of college as we speak and I had $10,000 to take a position, I might begin with the A’s. I’d begin going proper by means of corporations.”

Trending: Deloitte’s fastest-growing software program firm companions with Amazon, Walmart & Goal – Many are rushing to grab 4,000 of its pre-IPO shares for just $0.26/share!

His technique could be to concentrate on smaller corporations, the place “there’s extra likelihood that one thing is neglected.” He acknowledged that the investing panorama had modified since 1951, when he may leaf by means of inventory listings and discover apparent bargains. However the basic precept remained the identical: “It’s important to purchase companies – or little items of companies referred to as shares – and it’s important to purchase them at engaging costs, and it’s important to purchase into good companies.” Despite the fact that he mentioned this practically 26 years in the past, his recommendation nonetheless holds up. Some may argue that instances have modified, however Buffett was clear: “That recommendation would be the similar 100 years from now, when it comes to investing.”

Source link