00:00 Speaker A

What may I say the present yield curve says in regards to the economic system proper now?

00:05 Speaker B

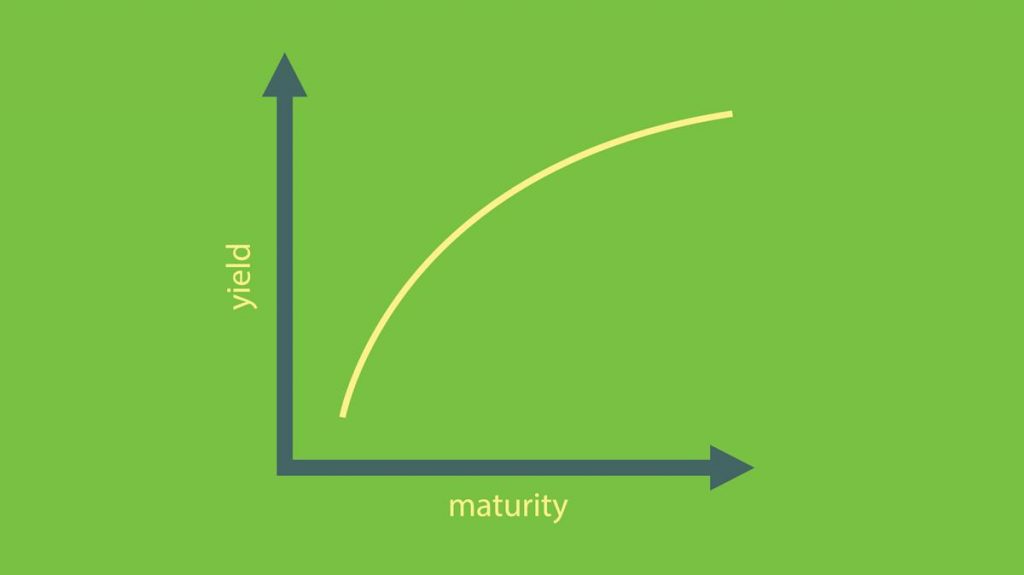

Oh, that is good. So, the slope of the curve offers you indications. You have received your regular yield curve. So give it some thought, if I’ve a shorter time period price, the Fed influences the entrance finish of the curve.

00:17 Speaker A

Appropriate.

00:18 Speaker B

That is the Fed, and so they do not management it, they affect.

00:25 Speaker A

Mhm.

00:27 Speaker B

That usually is low, if it is decrease, the Fed lowers charges, you anticipate what?

00:37 Speaker A

What?

00:38 Speaker B

Progress within the economic system.

00:40 Speaker A

Progress within the No, no pop quizzes, please.

00:44 Speaker B

Sure, sorry. Okay, you anticipate progress within the economic system.

00:48 Speaker A

However so the road ought to be sloping upwards.

00:51 Speaker B

Okay. Okay. If it is if it is flat,

00:58 Speaker A

Yeah.

00:59 Speaker B

meaning we’d have the expansion expectations are sort of stalled.

01:03 Speaker A

Okay, I stalled out.

01:05 Speaker B

That is a stagflation surroundings. Inverted, sure, we do not love.

01:13 Speaker A

I simply sorry. I do know. I just like the phrase, not the time period.

01:21 Speaker B

Sure, sure. Um, however then if it is inverted. Now take into consideration the inversion as a result of numerous instances we are going to say that the yield curve has inverted. We anticipate a recession. It takes about 13 months earlier than that occurs. The Fed inverts the yield curve as a result of they affect the entrance finish.

01:56 Speaker A

Mhm.

01:56 Speaker B

We anticipate progress to decelerate, therefore why it begins taking place. The entrance finish impacts your high-yield financial savings account, very, very quick finish. And that is you need to take note of the Fed if you happen to’ve received fluid money. And it is very prudent if you happen to anticipate them, particularly if we get a dot plot that claims we will decrease charges at the moment, you may need to lock within the charges earlier than they try this, if you happen to’ve received the additional money. Then it is all the best way that the federal government borrows cash may be very tied to the best way that we borrow cash. The three to 5 12 months intervals is tied to your auto loans.

02:41 Speaker A

Proper. There’s prime and there is margins connected to that. After which the ten 12 months.

02:47 Speaker B

10 12 months housing, proper? Rates of interest. Yeah. There we go.

02:51 Speaker A

Precisely. Precisely.

Source link