Why is Trump Crashing the Inventory Market? Trump inventory market woes are rocking retail merchants, however why is Trump crashing market?

For those who’re questioning why Trump is crashing the inventory market, there is perhaps a way to the president’s insanity. In hindsight, the inauguration was the highest sign.

Why did all people ignore it? Bitcoin nearly did 10x, and lots of alts like XRP did 10x. Nonetheless, some had been considering we had a 100x coming into the market.

We’re unironically, severely, and earnestly in a bear lure. Right here’s why Trump is doing that deliberately and the place we go from right here.

Why is Trump Crashing the Inventory Market: The Downside

The early days of Trump’s second time period hinted at a course correction, an opportunity to easy out the ad-hoc poor planning of his first presidency. That optimism was short-lived, as selections started to defy even his strongest backers.

Right here’s what went down:

- Act belligerent to each allied nation

- Enact across-the-board tariffs as an alternative of industry-specific ones, stroll again and pivot ahead once more a number of occasions, complicated traders

- Overtly speculate about annexing Greenland from Denmark (some of the pro-US nations in NATO)

- Beginning the cash printer once more to pay for rising imports regardless of tariffs (check out M2)

- Scare all of the migrant labor into hiding, additional slowing down the financial system

- Promote a memecoin along with your title in your first day in workplace. Dump it shortly after

99Bitcoins analysts surprise if it will result in the President being banned from saying something on social media whereas they’re in energy.

The Answer: Is All of This Deliberate?

Some argue Trump’s current strikes are much less about mishandling the financial system and extra about tapping the brakes to dodge a full-scale collapse.

For example, tariffs, usually slammed as crude coverage instruments, can work wonders when aimed good. Working example: Honda’s name to shift production of its new Civic from Mexico to Indiana by 2028. Trump’s 25% tariffs on Canadian and Mexican imports pushed the choice, promising an annual rollout of 210,000 vehicles.

Equally, the semiconductor {industry} is witnessing a paradigm shift. Taiwan Semiconductor Manufacturing Company (TSMC), the chip titan from Taiwan, is establishing store in Arizona, a transfer designed to dodge geopolitical landmines and align with U.S. efforts to lock down tech independence. Past the buzzwords, it means jobs—high-paying, expert ones that jumpstart native economies.

Tariffs would possibly pinch shoppers and the markets within the quick time period, however the price ticket is small in comparison with the payoff of a stronger home manufacturing base.

Is Trump Attempting to Set off a Rush on Bonds?

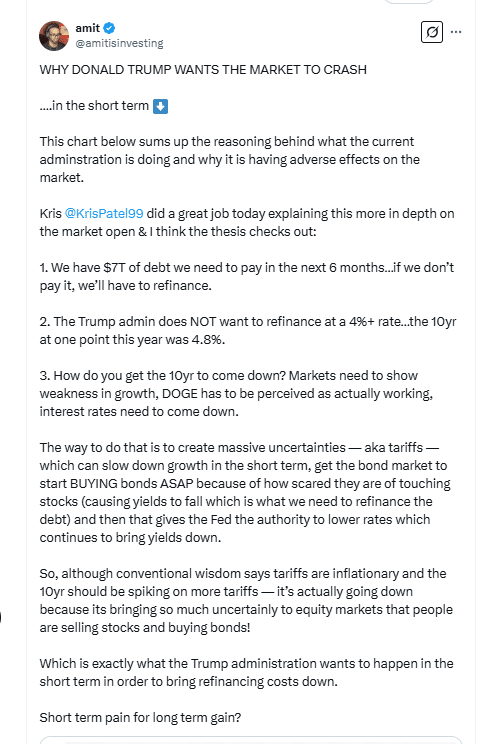

Whereas the market chaos may appear uncontrolled, there could possibly be extra strategies in Trump’s insanity, and the reply could possibly be within the upcoming US 10-year debt renewals.

Trump doesn’t wish to renew US debt at a excessive rate of interest and to create an atmosphere that may decrease charges; some speculate that Trump is actively attempting to lure capital out of equities and crypto into US Treasury bonds.

(Source)

Closing Thought

The true subject right here, we expect, is that the US authorities has no actual strategy to plan issues greater than two to 4 years forward, perhaps eight in the event that they’re fortunate.

It’s inherently unstable and unreliable on a long-term foundation. The presidential elections and the truth that the president solely has energy if the Home and Senate are aligned make it lots much less capable of decide to long-term work.

Xi Jinping of China has been president for 13 years. The man earlier than him, Hu Jintao, was president for 11. Over the pond, the UK had the Tories in energy for 13 years Labour in energy for 13 years earlier than that, and the Tories in energy for 18 years earlier than that.

The final time the US had a 12-year single-party run as president was Reagan into H.W. Bush.

You possibly can’t belief that something 2016 Trump says gained’t be overturned by 2020 Biden or that something 2020 Biden says gained’t be overturned by 2024 Trump. Hell, you’ll be able to’t belief that 2024 Trump gained’t overturn 2016 Trump.

Name it coordinated, name it chaos—both method, the indicators level to harsher storms forward within the markets earlier than restoration even enters the dialog.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

-

For those who’re asking why is Trump crashing the inventory market, there is perhaps a way to the president’s insanity. -

Some argue Trump’s current strikes are much less about mishandling the financial system and extra about tapping the brakes to dodge a full-scale collapse. -

For now, the controversy about cryptocurrency’s place in America’s monetary future is simply starting.

Source link