Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

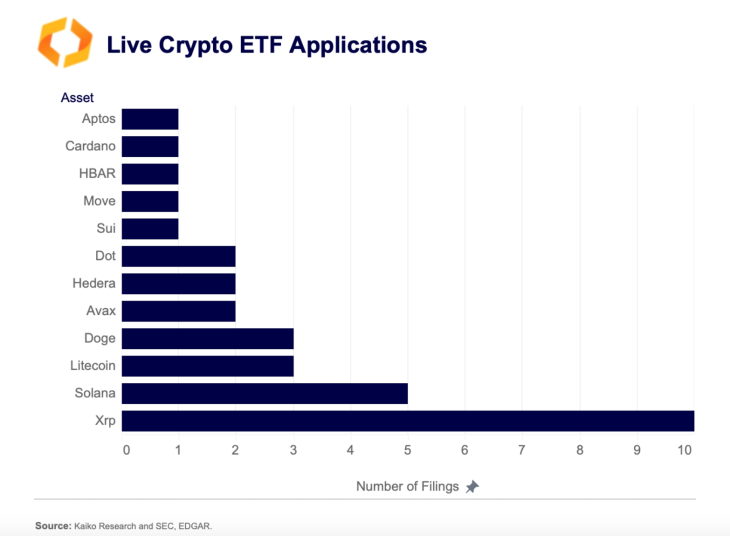

XRP stays one of the crucial standard cash available in the market, with a cult-like neighborhood that has supported it for years. With the bullish sentiment surrounding it, the altcoin has carried out fairly nicely and continues to encourage assist. The newest developments for XRP have been the ETF filings that counsel it is likely to be the subsequent altcoin to get an SEC nod after Ethereum. The variety of filings additionally places it nicely forward of investor favorites similar to Solana and Dogecoin within the operating for the subsequent ETF approval.

XRP ETF Filings Climb To 10

XRP ETF filings have been popping out of the market over the previous yr, particularly with the approvals of Ethereum Spot ETFs. These ETFs are anticipated to present institutional traders an official car to get correct publicity to the market. As Bitcoin and Ethereum ETFs have been carried out and dusted, issuers have appeared to different giant cap altcoins to carry into the market.

Associated Studying

The following favorites on the listing have been XRP, along with heavy hitters similar to Solana, Dogecoin, and Litecoin. Nevertheless, within the race, XRP has clearly differentiated itself by way of curiosity, boasting twice as many filings as another altcoin.

In keeping with data from Kaito Analysis, there are at present 10 XRP ETF filings pending approval or rejection from the SEC. In distinction, there are 5 Solana ETF filings, 3 Litecoin submitting, and three Dogecoin filings. This exhibits clearly that curiosity in XRP as the subsequent altcoin to achieve ETF approval is the best.

Moreover, the SEC has acknowledged the XRP ETF filings from business leaders similar to Grayscale. There are additionally filings from ProShares, Franklin Templeton, Bitwise, 21Shares, amongst others. Nevertheless, BlackRock has not made a move to file for an XRP ETF regardless of main the Bitcoin and Ethereum ETF campaigns.

However, the filings for XRP ETFs stay an enormous deal for the altcoinm and their approval might set off one other wave of value hikes.

ETFs And The SEC Battle Conclusion

For a lot of, the most important hindrance to an SEC approval of an XRP ETF was the continued battle between the crypto agency and the regulator, which started in 2020. Nevertheless, in March 2025, Ripple CEO Brad Garlinghouse announced that the case was officially over.

Associated Studying

With this growth, expectations that the regulator will look favorably upon an XRP ETF are excessive. If the ETFs are authorized, even with a fraction of the Bitcoin ETF volumes, the XRP value is predicted to blow up in response, with some analysts predicting that the altcoin’s price could rise to the double-digits.

Featured picture from Dall.E, chart from TradingView.com

Source link