The Nasdaq Composite‘s (NASDAQINDEX: ^IXIC) drop into correction territory bought traders apprehensive. The S&P 500‘s (SNPINDEX: ^GSPC) fall to correction ranges this week appears to have confirmed their issues. Underneath such situations, what’s an investor to do?

Many will transfer cash into sectors they view to be much less dangerous, reminiscent of shopper staples. Nevertheless, whereas there are good causes to see shopper staples firms as defensive picks, not all such shares are value shopping for. Listed here are three it is best to in all probability keep away from now, together with one with a tempting 10% dividend yield.

Consumer staples makers promote issues individuals purchase recurrently as a result of they’re, nearly by definition, requirements. Normally, these merchandise are additionally pretty low cost relative to their advantages. Chances are you’ll delay shopping for a brand new automobile when the financial system will get tough, however you in all probability will not reduce too far on meals, drinks, or toiletries.

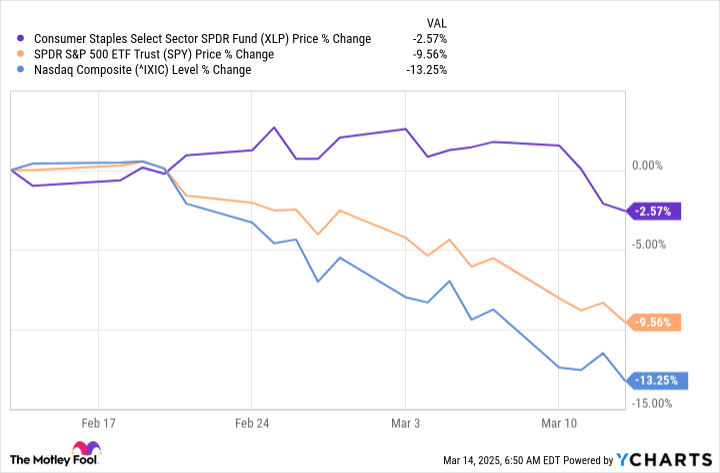

Because the chart above exhibits, over the previous month, the typical shopper staples inventory has fallen far lower than the S&P 500 index or the Nasdaq Composite. No inventory is totally secure from declines, however a minor dip actually feels higher than dropping 10% or extra of the worth of your portfolio in a market correction. And beneath that common are particular person firms, a few of which naturally carried out higher than common. PepsiCo (NASDAQ: PEP), for instance, is up 2.6% over the previous month, in distinction to the typical shopper staples inventory, which is down 2.6%. That is a greater than 5 proportion level outperformance.

PepsiCo’s features had been in all probability tied to the truth that it has been out of favor and had some floor to make up relative to its shopper staples friends. However it’s nonetheless performing moderately effectively as a enterprise. In 2024, the corporate’s natural gross sales rose 2% and its adjusted earnings jumped 9%. That is not so good as the outcomes from just some years in the past, when inflation allowed the corporate to push giant value hikes onto its clients, however it’s hardly a sign that PepsiCo has out of the blue misplaced its method.

In case you are searching for secure haven inventory investments now, PepsiCo, with its traditionally excessive 3.6% dividend yield, might be value contemplating. However meals makers Kraft Heinz (NASDAQ: KHC), Conagra Meals (NYSE: CAG), and B&G Meals (NYSE: BGS) are three you would possibly need to keep away from.

The story behind Kraft Heinz is pretty easy. It’s making an attempt to refocus its enterprise round its most essential manufacturers. However its gross sales in its “speed up” section (which options its greatest recognized and most essential manufacturers) decelerated at an rising charge as 2024 progressed. Within the first quarter, natural gross sales for these manufacturers rose 0.5%. Then it was all downhill, with drops of two.4% within the second quarter, 4.5% within the third, and 5.2% within the fourth. Kraft Heinz is clearly struggling. As such, it isn’t a secure place to cover from market turbulence regardless that the dividend yield is 5.3% and the inventory has been on the rise.

Source link