The FOMC Could 2025 price choice might shake Bitcoin, SPX, and even high Solana meme cash. Will Powell’s pause or reduce spark a crypto rally?

The Federal Open Market Committee (FOMC) will conclude its two-day assembly on Could 7 earlier than asserting whether or not its findings justify a price reduce, hike, or sustaining charges at 4.50%.

DISCOVER: 20+ Next Crypto to Explode in 2025

Eyes on the Federal Reserve

Forty-five minutes after the speed choice is introduced, Jerome Powell, FOMC Chair, will maintain a press convention, fielding questions from journalists.

Whereas price bulletins usually set off crypto worth volatility, the Powell presser usually strikes the market.

Inevitably, questions concerning the choice will probably be raised. His solutions will give analysts insights into the FOMC’s financial coverage path for the approaching months.

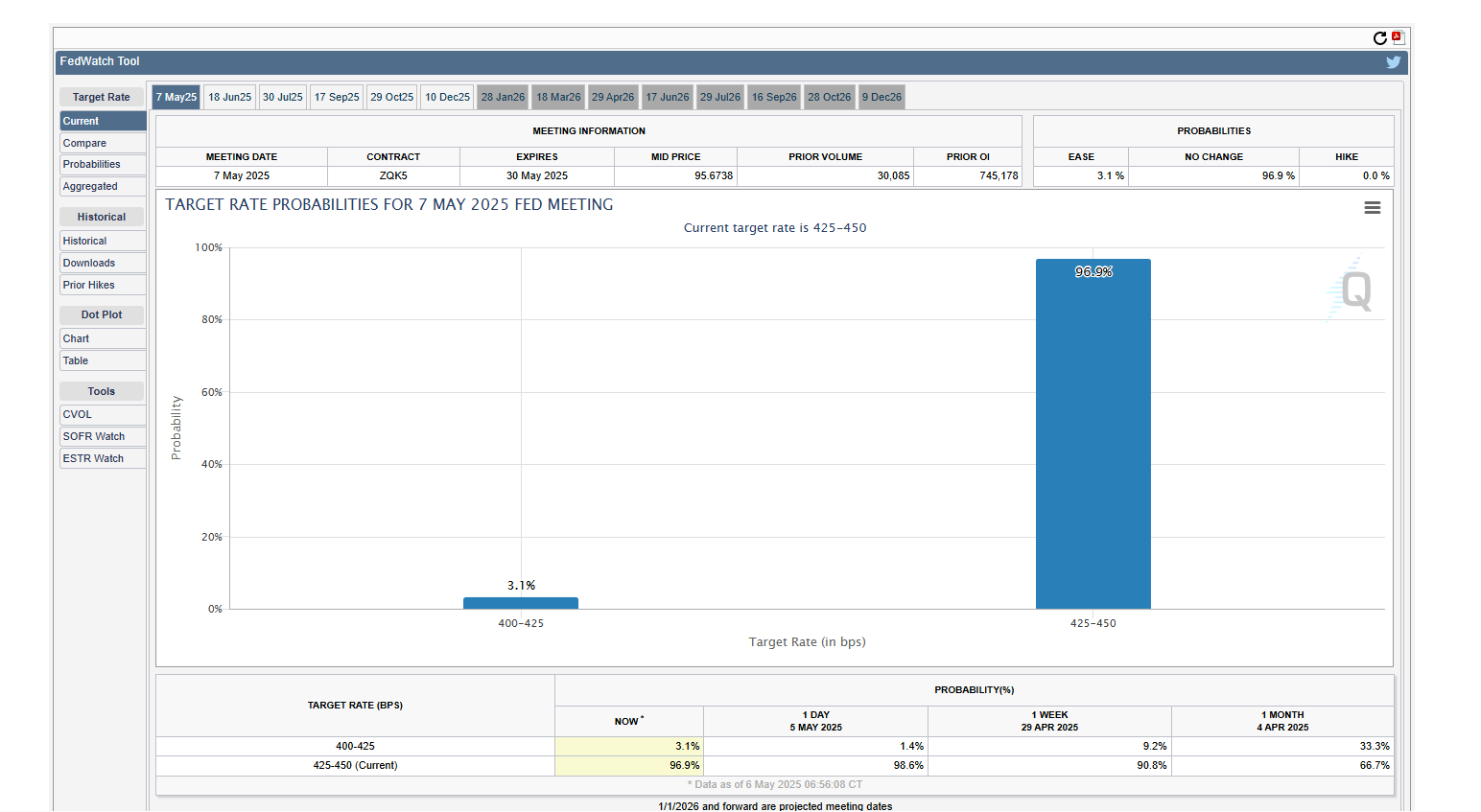

There’s a 97% likelihood of no price change at 4.50%, trying on the CME FedWatch Instrument.

(Source)

Nonetheless, if the FOMC yields to stress and cuts charges, crypto and Bitcoin costs might surge. The S&P 500 (SPX) may additionally lengthen positive factors above $6,000, channeling extra capital into equities.

Among the best cryptos within the high 30 might break native resistance ranges, pushing the overall market cap firmly above $3 trillion.

Conversely, sustaining or mountaineering charges might ship a extreme blow to Bitcoin and even among the best meme coin ICOs to invest in Could.

The Curiosity Charge Pause

If economists’ forecasts maintain and the FOMC votes to maintain charges regular, it is going to be the third consecutive assembly with out a price change.

The final price reduce was in December 2024, when the central financial institution lowered charges from 5.5%.

Within the earlier assembly, Powell justified the pause, citing the resilience of the U.S. financial system.

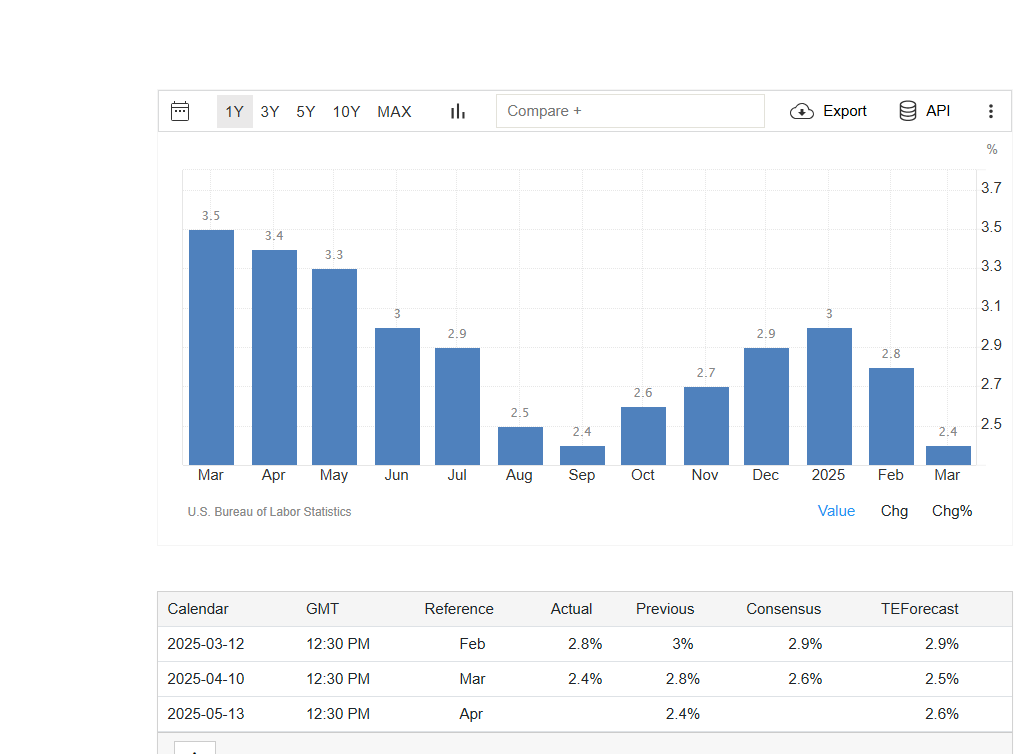

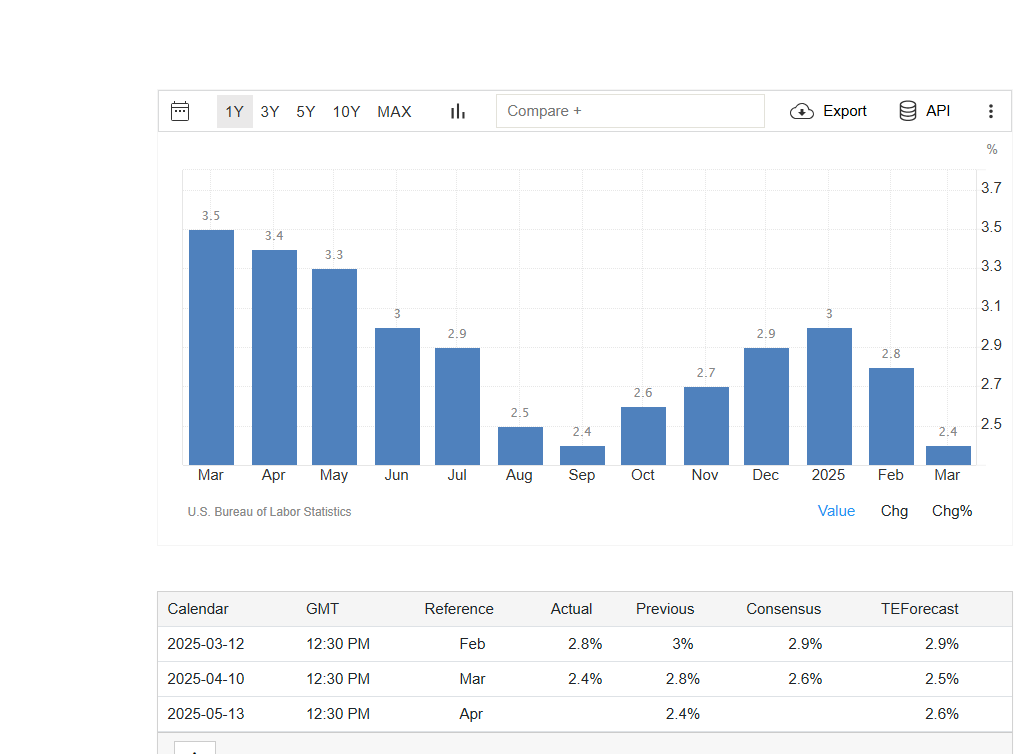

He famous that the labor market stays robust and inflation is moderating, although it stands at 2.4% year-on-year, above the two% goal.

(Source)

The dearth of clear ahead steerage on future cuts disenchanted traders hoping for a dovish surroundings conducive to SPX and crypto bulls to thrive.

Powell emphasised that the FOMC seeks “better readability,” aware of inflation and financial pressures from Donald Trump’s tariff insurance policies.

With out main commerce offers following the 90-day tariff pause, inflation forecasts stay elevated.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in May 2025

SPX Surge Mirrors Crypto Increase: What’s Subsequent?

SPX costs bottomed at $4,837 in early April earlier than surging after Donald Trump introduced a 90-day tariff pause to permit negotiations.

A commerce cope with China might considerably carry SPX, doubtlessly pushing costs above $5,800 in a bullish development continuation sample.

(SPX)

In early Could, China introduced tariff exemptions for 25% of U.S. imports.

Kevin O’Leary, also referred to as Mr. Fantastic, acknowledged {that a} main deal would stabilize markets and reassure traders, noting that “China is a distinct kettle of fish.”

Everyone wish to see deal one inked. Deal one would calm the markets, calm my traders, and calm all the businesses I’ve invested in.

China is a distinct kettle of fish. They don’t seem to be a tariff downside, they steal IP, they do not give us entry to their markets, they usually… pic.twitter.com/sv6vZidnpu

— Kevin O’Leary aka Mr. Fantastic (@kevinolearytv) May 1, 2025

Bitcoin and crypto costs might additionally rally, with BTC surging above $100,000, propelling different high cryptos to new valuations; a reduction after the Q1 2025 hammering.

DISCOVER: Top Solana Meme Coins 2025: 7 Best Buys Updated

FOMC Assembly: Will SPX and Bitcoin Rally Or Dump?

-

The Federal Reserve Could 7 price choice is in focus, will the central financial institution slash charges? -

Powell will carry or set off a sell-off in SPX and equities -

Economists predict charges to regular at 4.50% -

Will Bitcoin lengthen positive factors and breach $100,000?

Source link