Chainlink (LINK) has skilled a major surge in its value, which analysts are attributing to the extra acquisition of World Liberty Monetary (WLFI) and the rumors of a brewing partnership with Cardano.

Associated Studying

Chainlink might be off to a very good begin because the crypto token was in a position to pull off a giant run that propelled the coin from its lowest degree to succeed in over $26 per coin.

Chainlink 30% Worth Surge

Analysts mentioned that Chainlink has efficiently positioned itself within the blockchain panorama after breaking the stoop that noticed the token at its lowest degree this 12 months and gaining momentum to surpass its March 2024 excessive of $22.87

Information confirmed that the crypto token’s value skyrocketed by 40% to hit $26.85 per coin. The come-from-behind rally additionally pushed the market capitalization to almost $17 billion. In the meantime, LINK was up 30% within the final seven days, information from Coingecko reveals.

Market observers famous that LINK’s positive aspects to succeed in $26.87 have allowed the token to recover from the resistance degree of $22.87, which some analysts steered the token might be transferring in direction of a extremely bullish situation.

The cup and deal with sample methodology confirmed there’s a excessive risk that Chainlink would attain its goal of $37, which an analyst explains,

“The revenue goal for this sample is calculated by measuring the depth of the cup and projecting the identical distance upward from the breakout level.”

WLFI Acquires Extra Tokens

One of many causes seen by crypto analysts that drive Chainlink’s value in an upward route is the Trump-associated WLFI which purchased a major variety of tokens.

In response to Nansen, about $4.6 million value of LINK tokens have been acquired by WLFI, bolstering their Chainlink holdings to greater than $6.6 million value of tokens.

Some analysts identified the potential for the US Securities and Trade Fee (SEC) approving a Chainlink ETF if an utility is submitted, noting that Trump’s crypto coverage may positively have an effect on these tokens.

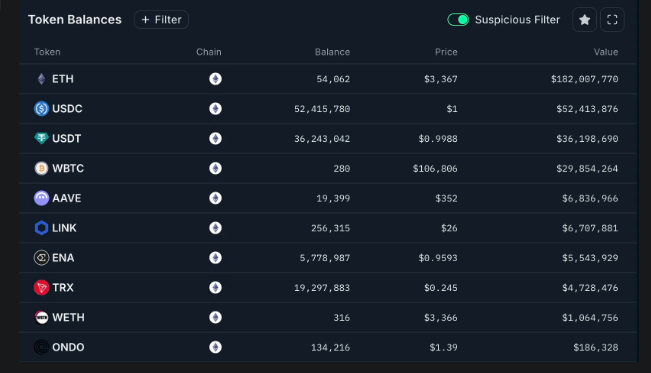

Furthermore, information confirmed that WLFI holds $179 million value of Ethereum tokens along with different property like USD Coin, Tether, Wrapped Bitcoin, AAVE, Ethena, and Tron. It’s estimated that WLFI has a portfolio that exceeds $322 million in worth.

Now that we’ve governance transferring alongside very well, this 12 months I’m going to focus deeply on three massive themes for Cardano:

1) Bitcoin DeFi on Cardano (Market is 4 instances the scale of Ethereum and Solana mixed)

2) 24/7 work on scalability, together with Leios

3) Making Cardano a…— Charles Hoskinson (@IOHK_Charles) January 18, 2025

Associated Studying

Potential Cardano Partnership

One other issue that contributed to Chainlink’s value surge is the rumor that Cardano may have a partnership cope with the token.

At least the Cardano founder, Charles Hoskinson, hinted {that a} potential collaboration is underway, saying they wish to construct extra partnerships this 12 months.

In response to Hoskinson, considered one of his targets this 12 months is to make Cardano “a peninsula, not an island.”

“Integrations, integrations, integrations. Already obtained a gathering with Chainlink on the books,” the Cardano founder mentioned in a put up.

Featured picture from CoinFlip.tech, chart from TradingView

Source link